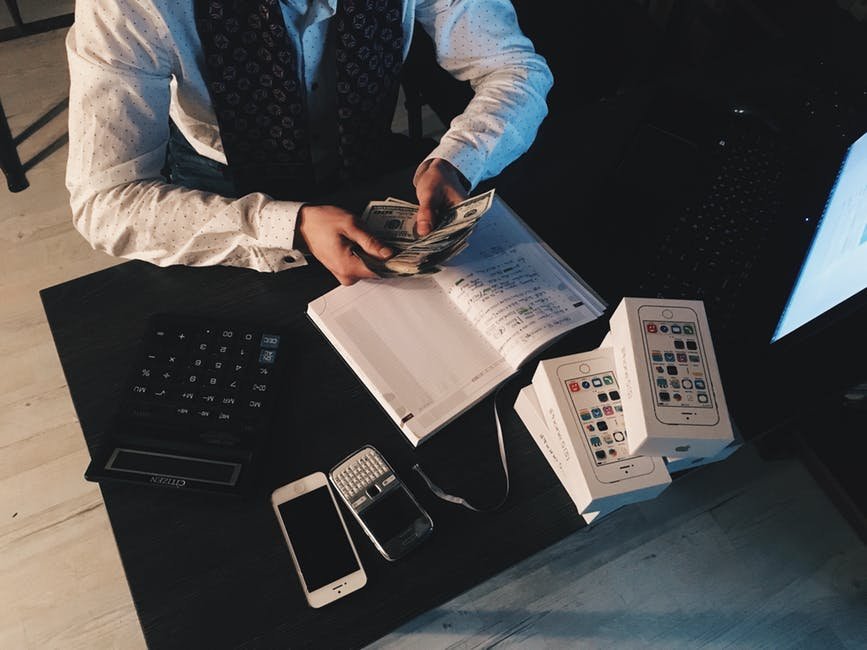

It is quite challenging to juggle both your business and your own paperwork at the same time. You will not be getting your pay stub listing of all the earnings and tax deduction you had unlike traditional employees.You can read more here.

If that is true that it means independent contractor pay stub is non-existent! If you can't show the proof of wages then that means you can't get a new car, a new home or a credit card because those are the paperwork you need to provide. Make sure to read the article below if you want to know more about independent contractor pay stub and how to obtain it.

What does independent contractor pay stub do actually?

If you don't the best read the article below because it will define the difference an employee and an independent contractor.

An employee will most likely be doing different sets of work.

You will be assigned a set of working hours.

You will have taxes deducted from your paycheck.

You will be trained by the company that you will be working in and learn how to do your work. The manager is going to be the one that will assign you on what to work on. You will wait for the company to give you the things you need for your job, You will be working for one employer. You will be able to enjoy benefits like pay on the holidays and sick leave; you will also have health insurance.To know more click the following link https://www.paystubcreator.net/blog/general-knowledge/is-there-an-independent-contractor-pay-stub.

If you want to have a free schedule whenever you want then being a contractor is what you should aim for. As a contractor, you will be responsible for your own taxes.

A contractor will have to supply his own tools and equipment for the job. You can either accept or refuse work on your own accord. A contractor will rely on his own knowledge to do the job. You can essentially work for any client or company that you can handle.

A contractor will not get benefits that will be beyond their paychecks. This is what an independent contractor is all about and if you are experiencing the same then you are not the only one.

You need to understand the difference between the two so that you can find out why you are having too much delay on your paperwork; as an independent contractor, you need help with your pay stub which is why this article is telling you to do so. If you need any help with your career being a contractor, this article will be your best bet right now so make use of it.To know more about pay stub click the following link: https://en.wikipedia.org/wiki/Payroll.